Real Estate Investment Strategy, Data Analytics & AI Models: US Multifamily

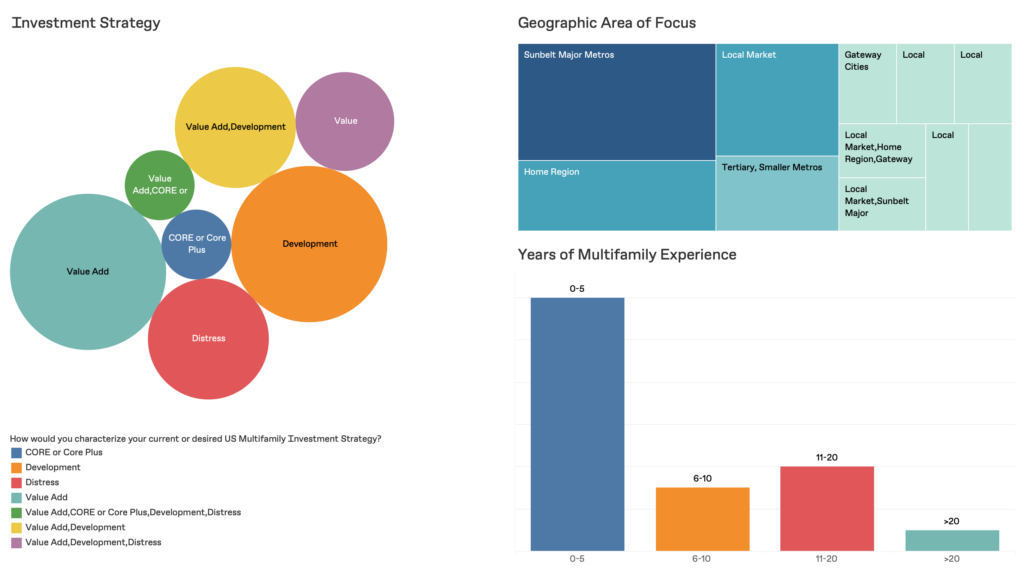

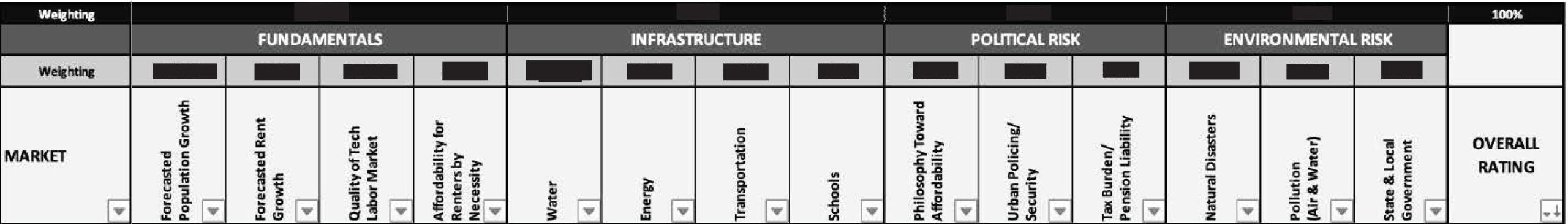

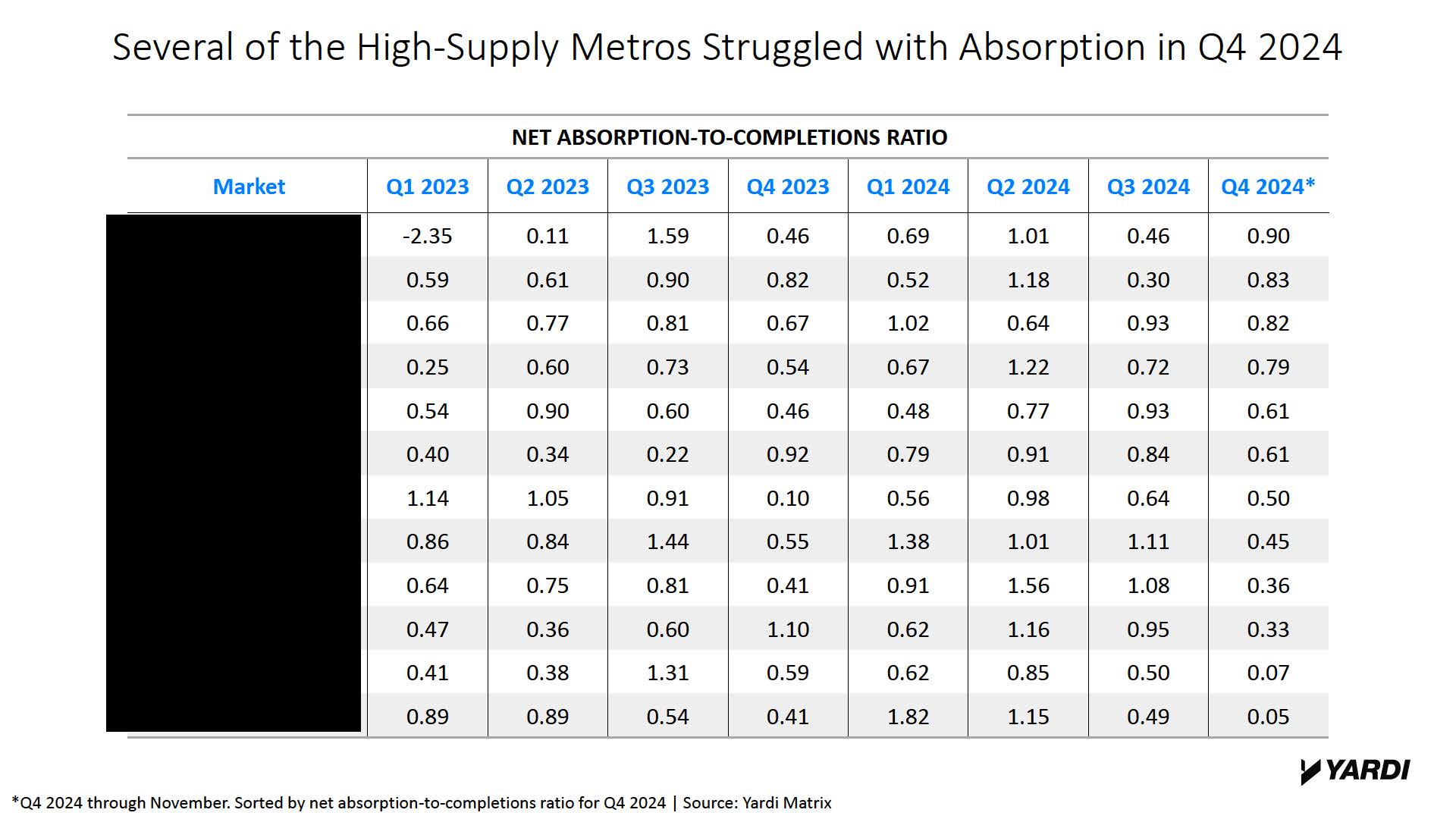

Participants learn the state of US multifamily investing and gain the tools to form a cohesive real estate investment perspective, before vetting their strategy with a cutting-edge AI model.

Commercial real estate investment professionals must make wise decisions, yet we’re awash in often meaningless and contradictory information that passes for “data.” This program will give you the tools to form an integrated real estate investment perspective that enables action and, most importantly, better results.

Taught by a real estate economist and data expert, new and experienced real estate investors alike will learn to use technology, proprietary data, and a proven framework to form a cohesive strategy, elevate decision-making, and improve investment outcomes. Participants will be challenged to vet their strategy with a proprietary AI investment analysis model.

What to Expect

Instructor

Jeff Adler

Vice President, Matrix

Yardi Systems, Inc.

Recent Participant Feedback

The perfect combination of market analysis theory and practical decision-making.

Six of the most productive hours I’ve ever spent in a conference.

Essential knowledge for a real estate investor, in the age of digitalization of the sector. Very useful and will help me make better investment decisions.

Excellent program for both industry experts and new real-estate investors.

– Past participants in the program

Registration is open

Real Estate Investment Strategy, Data Analytics & AI Models: US Multifamily

December 3, 5, & 8, 2025 | 11:00am – 01:00pm Eastern

Online

Tuition: $1,500 (through October 15), $1,700

CEUs: Pending

AMDP Elective Units: 1

Program size is limited and early registration is recommended.

Registration Benefits, Discounts, & Deadlines

Registration for this program grants you access to and personalized training on enterprise-level investment software with proprietary US market data on US multifamily housing. Access is granted from the start of the program until two weeks after the program and is included in program tuition. For this session, participants will also be able to use a proprietary AI investment analysis model.

Please email us at [email protected] with any questions and to ask about group signup.

Registration Deadline: 3 hours before the start of the program.