Real Estate Investment Strategy, AI Models, & Data Analytics: US Multifamily in April 2026

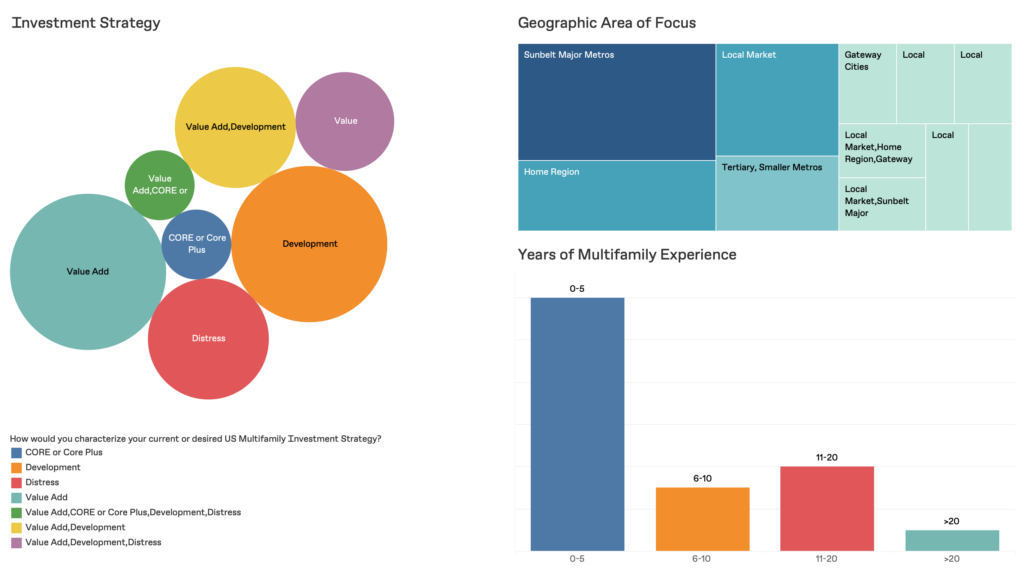

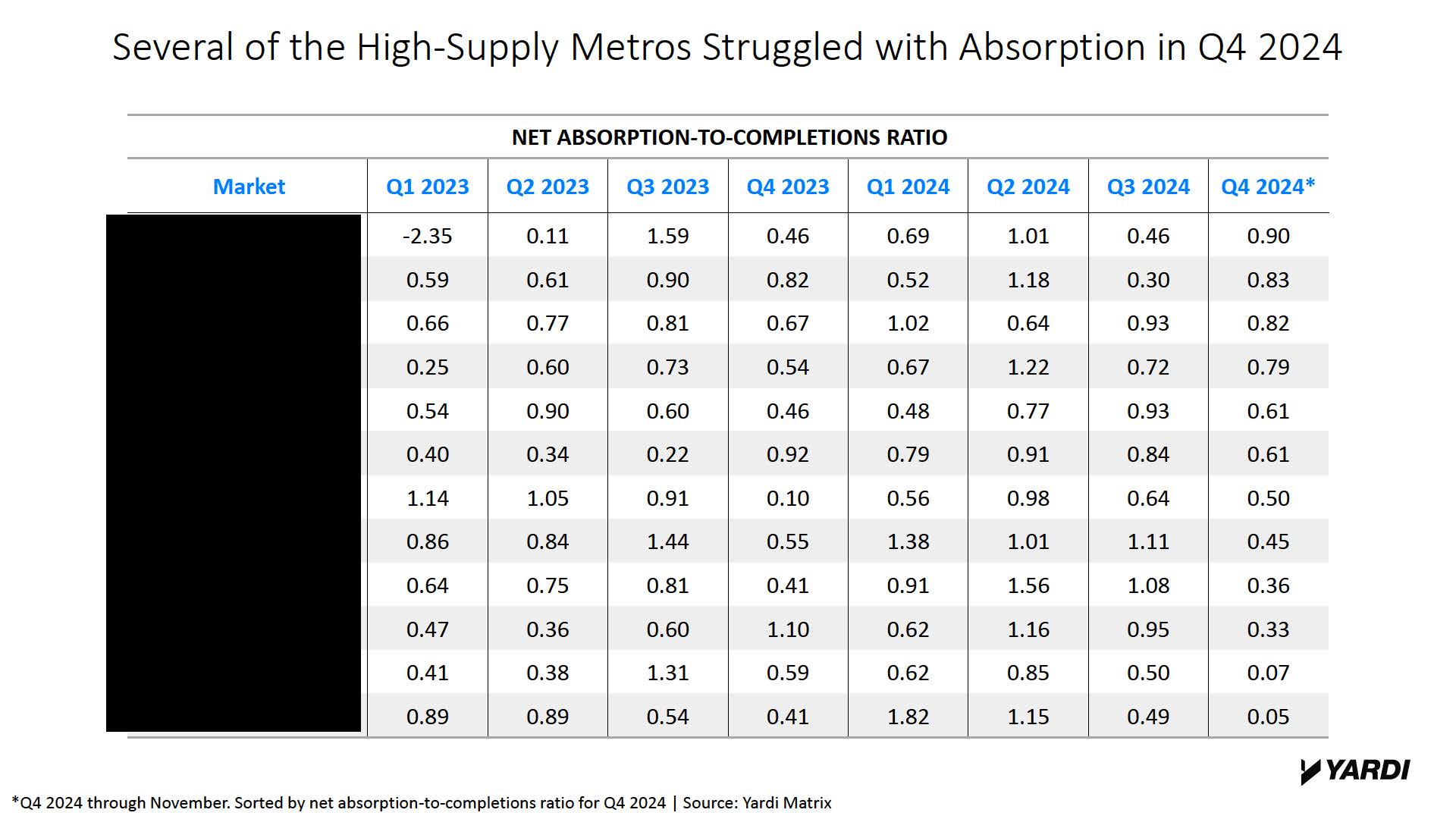

Participants receive a to-the-moment overview of US multifamily investment trends, gaining the tools to form a cohesive real estate investment perspective. They then explore a cutting-edge AI investment tool and apply it to one of their projects.

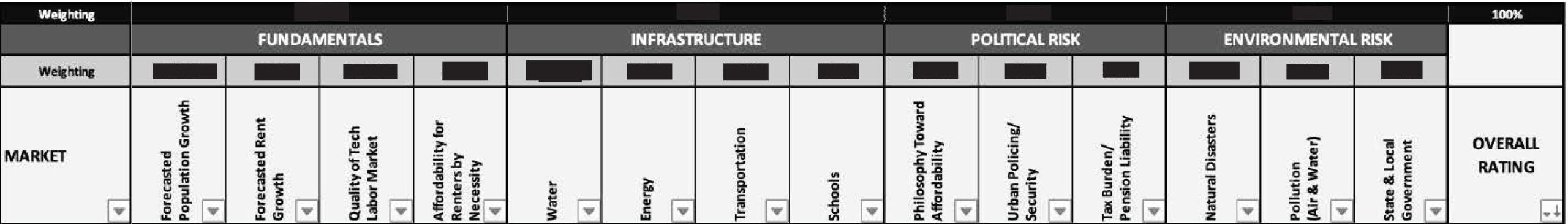

Commercial real estate investment professionals must make informed decisions, yet we’re often inundated with meaningless and contradictory information that masquerades as “data.” This program will equip you with the tools to develop an integrated real estate investment perspective that enables action and, most importantly, yields better results.

Taught by a real estate economist and data expert, both new and experienced real estate investors will learn to utilize technology (including a cutting-edge AI tool), proprietary data, and a proven framework to develop a cohesive strategy, enhance decision-making, and optimize investment outcomes. Participants will explore real deals closed in the tricky contemporary financing environment and be challenged to apply AI-powered insights to their own projects.

What to Expect

Instructor

Jeff Adler

Vice President, Matrix

Yardi Systems, Inc.

Recent Participant Feedback

Great course and instructor. Real estate investors must stay on the cutting edge of technology to compete, and tools and trainings like this are a simple, effective way to do that.

The perfect combination of market analysis theory and practical decision-making.

Excellent program for both industry experts and new real-estate investors.

The first look at Yardi’s AI tool was super helpful as we develop our own strategy for using AI to facilitate real estate analysis and investment.

The program has been excellent. Great exposure to methodologies and the latest tools.

– Past participants in the program

Registration is now open

Real Estate Investment Strategy, AI Models, & Data Analytics: US Multifamily in April 2026

April 15, 17, & 20, 2026 | 11:00am – 01:00pm Eastern

Online

Tuition: $1,700

CEUs: 6 AIA LUs, 6 AICP/CM, 6 LA/CES

AMDP Elective Units: 1

Program size is limited and early registration is recommended.

Program Brochure

Interested in a program brochure? Enter your email below and access a download link.

Registration Benefits, Discounts, & Deadlines

Software Access: Registration for this program grants you access to and personalized training on enterprise-level investment software with proprietary US market data on US multifamily housing. Access is granted from the start of the program until two weeks after the program’s completion and is included in the program tuition. Participants will also have the opportunity to utilize a proprietary AI investment analysis model.

Instructor Tutorial: There is an optional instructor tutorial on this software.

Please email us at [email protected] with any questions and to ask about group signup.

Registration Deadline: 3 hours before the start of the program.