Real Estate Pros Become Harvard Alums with this Executive Development Program

Note: A version of this article was published on The Real Deal on March 1, 2024.

Once you’ve climbed the corporate ladder all the way to the C-suite, the only place to go is back to school to join the Ivy League.

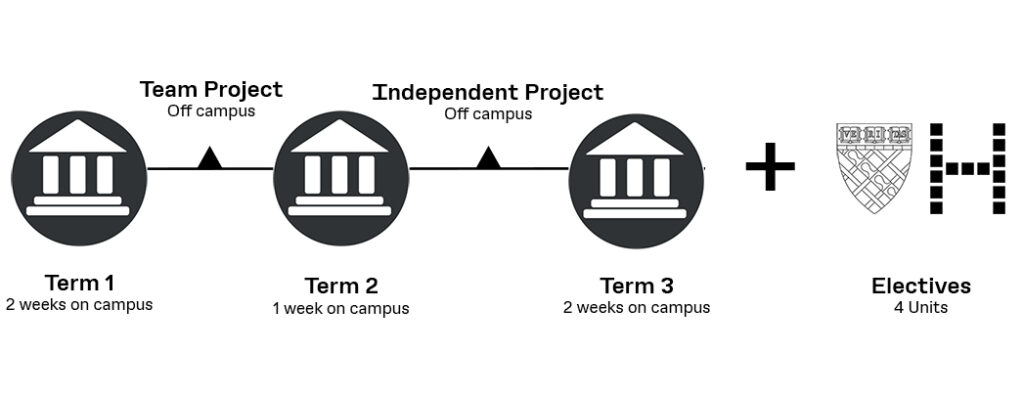

Created for the world’s highest-achieving real estate executives, the Advanced Management Development Program in Real Estate (AMDP) at the Harvard University Graduate School of Design leverages the venerable institution’s ample resources to help participants reach the absolute pinnacle of their profession. The intensive one-year program with five weeks spent on campus brings participants into contact with industry leaders from around the world via on-campus sessions, site visits, and project-based learning, culminating in graduates being granted Harvard alumni status. The Real Deal sat down with three program alumni, Trusted Inc. Founder and CEO Michael Peters, Class of 2015, Unico Developers Principal and Co-founder Fernando Levy Hara, Class of 2010, and Raouf Advisory Founder and Chief Advisor Hussam Raouf, Class of 2017, to get an inside look at this unique educational and professional growth opportunity.

“The Most Exclusive Real Estate Club in the World”

The AMDP is designed as a way for real estate professionals to grow beyond the C-suite by connecting with and learning from an international cohort of like-minded industry leaders over the course of an intense year of classes and projects. For some, the program can be a way to pivot in the face of a challenging market, while for others it’s an opportunity to break into new markets. Upon graduation, participants join an elite set of experts and gain access not only to Harvard’s alumni network but also the more select pool of AMDP alums, a group that has been called the most exclusive real estate club in the world.

Each year’s AMDP class consists of industry leaders from around the world, who spend a total of five weeks on campus throughout the year. In recognition of its participants’ crowded schedules, the AMDP is broken up into a series of one- and two-week intensive terms held on Harvard’s campus, allowing for busy executives to fit the coursework into their existing workload. Peters was attracted to the program in part because of this concentrated schedule. “I was running two tech companies at the time,” he recalls, “so I couldn’t really spend two years on campus.”

But, as Levy Hara says, “Real estate is not medicine. 50% is reading and learning, but the other part is having boots on the ground every day.” That’s why, on top of this coursework, the program’s curriculum is built around a pair of projects, one group and one individual, each of which presents the participants with unique challenges and opportunities based around real-world development scenarios.

Learning By Doing

The first project is a competitive group thesis for which the class is divided into six or seven teams whose members each bring a unique professional and geographical perspective to the task. Peters, who has contributed his expertise to the AMDP to help administer this phase of the program, explains how the teams are divided up to include as diverse an array of experts as possible, ensuring that the members can learn from one another throughout the process. The teams are then presented with the same multi-billion dollar development opportunity and tasked with creating a proposal to be judged by a panel of industry experts and faculty members (The 2023 panel included AMDP faculty co chairs Richard Peiser and Bing Wang, AMDP alum and Chair, Ontario Land Tribunal, Michael Kraljevic, and architect Gordon Gill, seen below).

The alums all spoke about how working with peers from around the world opens participants’ eyes to new ways of looking at development problems. “The teams will have members from three or four different countries, and they’ll attack problems very differently because of their international experiences,” says Peters. “Eight years ago, we had a genius from Poland who successfully drew on some European-centric financial modeling for a huge project in the Boston area.”

The teams do copious research for their projects, from visiting the site and meeting with stakeholders, including government officials and investors, to creating a 10-year spreadsheet showing how their proposal will play out in the long term. The projects are then presented to a panel of judges, which selects the winner. Despite being a theoretical exercise, the projects address real-world developments, and some aspects are later adopted; in the wake of a series of proposals based in the DC area, Peters recalls how “little pieces from the winning projects of all these different years started showing up in Hill East and near RFK.”

An Immediate Return on Investment

Participants have more latitude when determining the topic for their individual project, which often builds on work they’ve already been doing in their careers. Levy Hara’s project was a continuation of a business venture he founded with another AMDP participant during the second week of the program. “I had a couple classes that opened my eyes, one about distressed properties and the other about real estate cycles,” explains Levy Hara, who had come to the AMDP in the wake of the 2008 Housing Crisis. Levy Hara wasted no time creating a joint venture with Austrian developer Stephan Gietl, buying distressed notes from banks in South Florida. “We were buying at 25 cents on the dollar,” he says. “It was a life-changing opportunity.” The pair used their individual project as an opportunity to outline a thesis for this buying strategy, “with all our professors serving as our advisors for free.” Levy Hara recalls meeting up with one of these advisors in a bar years later. “He told me, ‘I should have invested in your fund because I would have made a ton of money.’”

For Raouf, the individual thesis was an opportunity to work on a project that was very personal to him. The Syrian-born executive watched his hometown of Damascus be ravaged by a decade of war, and his thesis tackled the topic of reconstructing cities in the wake of conflict. Raouf took advantage of the resources granted him via the AMDP to turn his ideas into a fully-fledged thesis. “I presented my project as a framework for reconstruction of Syria,” he explains, evaluating everything from the cost of the destruction to the framework for funding initiatives that would rebuild Syria’s urban fabric. Raouf’s presentation not only brought some members of his audience to tears but sparked the creation of a network of donors who are still working to rebuild Damascus today.

The Value of Being a Harvard Alum

On top of the knowledge they gained and connections they made during their time in the AMDP, the alumni we spoke with all emphasized how being a Harvard alum opened doors for them. “It’s amazing how influential it is,” says Levy Hara, who recalled how simply mentioning that he was a Harvard alum recently helped him secure a GC in the overheated Florida multifamily market. “We had interviewed three or four companies to build our project in Cape Coral, and none were interested,” he recalls. “Then with the fifth one, I mentioned Harvard, and now he’s my GC.”

Raouf was able to gain access to red-hot real estate markets in the Middle East via alumni connections he made after graduating from the AMDP. “That’s the direct value,” he says. “The indirect value is the association with such a great institution. When someone approaches you as a Harvard alum, their initial perspective and expectation change.” Of course, this raised expectation is a double-edged sword. “You need to keep up with the brand,” Raouf says with a laugh.